User Tag List

Thanks: 0

Thanks: 0

Results 1 to 11 of 11

-

11-26-2022, 07:48 PM #1

First time in 15 years oil from Venezuela

Can only be sold to the USA

https://www.washingtonpost.com/natio...oil-venezuela/

U.S. grants Chevron license to pump oil in Venezuela

Sanctions were eased following a government-opposition agreement on humanitarian aid and further discussions on elections.

By Karen DeYoung

[COLOR=var(--wpds-colors-gray80)]November 26, 2022 at 5:34 p.m. EST

The Biden administration said on Saturday it would lift a key oil sanction against Venezuela, marking the first significant crack in a years-long U.S. embargo that could eventually help ease the tight global energy market.

Chevron, the only remaining active U.S. oil company in Venezuela, is part of a joint venture with the country’s state oil company but has been barred by sanctions from operations there. Under a new Treasury Department license, it will be able to resume pumping oil. The limited license stipulates that any oil produced can only be exported to the United States. No profits from its sale can go to the Venezuelan state-owned company but must be used to pay off Venezuelan creditors in the United States.

The move came as the government of Nicolás Maduro held its first formal talks with Venezuela’s opposition coalition in more than a year. Meeting in Mexico City on Saturday, the two sides agreed to ask the United Nations to manage several billion dollars in government funds held in foreign banks that will be unfrozen to help assuage a humanitarian crisis in Venezuela.

The negotiators also agreed to continue talks next month to discuss a timetable for “free” elections in 2024 and human rights issues.

“We have long made clear we believe the best solution in Venezuela is a negotiated one between Venezuelans,” said a senior Biden administration official who spoke on the condition of anonymity under rules set by the White House. “To encourage this, we have also said we were willing to provide targeted sanctions relief.”[/COLOR]

The policy “remains open to further calibrating sanctions,” the official said. “But any additional action will require additional concrete steps,” including the release of political prisoners and recognition of opposition legitimacy, as well as unfettered access for U.N. humanitarian missions.

The official dismissed reports that the administration was acting to ease an oil shortage and high energy prices exacerbated by Russia’s invasion of Ukraine. “Allowing Chevron to begin to lift oil from Venezuela is not something that is going to impact international oil prices. This is really about Venezuela and the Venezuelan process,” the official said, where the United States is “supporting a peaceful, negotiated outcome to the political, humanitarian and economic crisis.”

Venezuela has the world’s largest oil reserves, slightly more than Saudi Arabia, although its thick crude is more difficult to extract. But its production faltered due to poor government management even before Maduro took over in 2013 after he death of Hugo Chávez, a former military officer who was elected in 1998.

U.S. sanctions against Venezuela that began 15 years ago on grounds of drug trafficking, corruption and human rights abuses gradually expanded, culminating under Donald Trump’s administration. Trump sharply tightened measures against the state oil company, Petróleos de Venezuela, S.A. or PDVSA; the central bank; and individuals and companies. U.S. oil company activities there were almost completely banned.

]The sanctions were an attempt to block global revenue from oil sales, and production fell sharply as black market exports have been sold primarily to China and India. When the Venezuelan opposition declared December 2018 elections illegitimate, it recognized Juan Guaidó, the opposition leader in the parliament, as interim president. The United States quickly followed suit, recruiting dozens of other Latin American countries to do the same.

But economic and political pressure on Maduro had little effect, and the Venezuelan people bore the brunt of a failing economy and repression, leading millions to flee to neighboring countries as well as to the United States, where the number of Venezuelan refugees has swelled.[/COLOR]

[COLOR=var(--wpds-colors-gray40)]President Biden came to office convinced that Trump’s Venezuela policy had failed, but he took few steps to reverse it, as powerful lawmakers vowed to block any action and the administration retained hopes of winning the midterm votes of anti-Maduro Venezuelans and other Latin Americans in Florida. As recently as the summer, Biden called Guaidó to assure him of continued American recognition and support, even as other governments and members of Guaido’s own opposition coalition were turning away from him and calling for negotiations with Maduro.[/COLOR]

[COLOR=var(--wpds-colors-gray40)]The Republican electoral rout in Florida appeared to convince the administration it was time to move. Chevron officials have said it will take some time to get their operations up and running again in Venezuela.[/COLOR]

[COLOR=var(--wpds-colors-gray40)]The sanctions change appears to be an agile circumvention of a main complaint of U.S. critics — the possibility that the Maduro government would benefit directly. Under the terms of the license, PDVSA is cut off from any profits its joint venture may make with Chevron.[/COLOR]

[COLOR=var(--wpds-colors-gray40)]But Maduro would not be any worse off than he is now, and one crack in the sanctions may lead to others. For the administration, assuming negotiations with the opposition continues toward democratic elections and human rights improvements, any loosening of global energy supply is seen as positive.[/COLOR]

[COLOR=var(--wpds-colors-gray40)]In a statement Saturday on the resumption of talks in Mexico, Sen. Robert Menendez (D-N.J.), the chairman of the Senate Foreign Relations Committee and a longtime hard-liner on Venezuela, said that “if Maduro again tries to use these negotiations to buy time to further consolidate his criminal dictatorship, the United States and our international partners must snap back the full force of our sanctions that brought his regime to the negotiating table in the first place.”[/COLOR]Last edited by CUDA; 11-26-2022 at 07:53 PM.

We have invented the world; WE see

-

11-26-2022, 08:26 PM #2

I forgot there oil burned cleaner than ours��

-

11-26-2022, 10:47 PM #3

What a smart move. Instead of using the oil in the USA that puts people to work, lowering the price of oil and helps the economy, lets send money to a repressive government. Woo Hoo!

I guess that's Joe's plan. Send money to Venezuela, Saudi Arabia and Russia. Funny how the left seems to hate Saudi Arabia but would rather get oil from there than the USA. Clown World in full effect.-----------------------

93 STV Mod VP/MERC 2.5 200

-----

The Bible is life's instruction manual.

Proverbs 4:18-20

" For a nation that is afraid to let its people judge the truth and falsehood in an open market is a nation that is afraid of its people."

-- John F. Kennedy 1962

-

-

11-27-2022, 12:13 AM #4

Wow, that's something to be ashamed of... I can't believe you posted that.

U.S. sanctions are designed to ensure that Maduro and his cronies don’t profit from illegal gold mining, state-operated oil operations, or other business transactions that would enable the regime’s criminal activity and human rights abuses.

Let's just go ahead and make America great again!

-

CDave liked this post

CDave liked this post

-

11-27-2022, 01:18 AM #5

8000 RPM

8000 RPM

- Join Date

- Oct 2011

- Location

- Southern California

- Posts

- 3,567

- Thanks (Given)

- 179

- Thanks (Received)

- 471

- Likes (Given)

- 3405

- Likes (Received)

- 2329

- Mentioned

- 29 Post(s)

- Tagged

- 0 Thread(s)

-

11-27-2022, 01:49 AM #6

It;s not possable...

https://www.americanprogress.org/art...-independence/

5 Reasons Why the United States Can’t Drill Its Way to Energy Independence

The solution to high energy prices is a swift and urgent transition to clean energy—not further reliance on dirty fuels controlled by dictators and profiteering oil corporations.

Vladimir Putin’s unjustified attack on Ukraine has upended the global fossil fuel market. The United States and its allies have responded with devastating sanctions, including a recent action from President Joe Biden to ban Russian oil, natural gas, and coal imports to the United States. Because international energy markets have been tied to fossil fuels for decades, this ban could result in higher gas prices for American households and supply disruptions for our European allies. The solution to this price crunch is a swift and urgent transition to clean energy—not more leasing, drilling, or investments in the same volatile fuel sources that are contributing to the current energy crisis.

Despite the oil and gas industry’s vigorous and incorrect public relations campaigns aimed at convincing people that their opportunism to drill more is a legitimate policy solution, the United States is already the world’s largest producer of oil and gas. Domestic oil production is at 90 percent of America’s all-time, pre-pandemic high, and the United States is producing more than twice as many barrels of oil per day as it produced in 2008. But energy independence won’t be found at the bottom of a well. We can never be energy independent while we rely on a fuel source that is both controlled by the global market and highly susceptible to international conflict and manipulation by autocratic regimes.

The fossil fuel industry’s wish list—more taxpayer subsidies, more land opened for dirty drilling, and fewer environmental and health safeguards—will not help people struggling with the price of gas today. But granting them free rein will lock the United States into decades of higher and more volatile energy prices; higher toxic emissions; and greater climate destruction. Now is the time for the United States to finally achieve real energy security by reducing our dependence on fossil fuels.

The oil and gas industry already has plenty of land and ocean ready to be used

The oil industry can decide to produce more oil whenever it wants. In fact, the oil industry already possess more than 9,000 approved—but unused—drilling permits on federal lands. Nearly 5,000 of those permits were approved in 2021 alone—the highest figure since the second Bush administration.

9,000

Approved permits to drill that are unused by the U.S. oil and gas industry

The number of permits already approved is about six times the average number of wells drilled annually in the past five years. Over the past 10 years, permits and wells drilled have followed a similar trajectory—except for now, when permits have increased and wells drilled have decreased. The oil industry has all it needs to increase production but has chosen to profiteer off the current crisis rather than act.Industry CEOs are profiting hand over fist while average families suffer

Meanwhile oil and gas executives are raking in windfall profits while consumers suffer at the pump. Last year, four of the major oil companies—Shell, Chevron, BP, and ExxonMobil—posted record profits, totaling $75 billion. In the fourth quarter alone, ExxonMobil was bringing in $97 million dollars in profit every day.

The reason that U.S. oil companies haven’t increased production is simple: They decided to use their billions in profits to pay dividends to their CEOs and wealthy shareholders and simply haven’t chosen to invest in new oil production. According to Bloomberg, “U.S. oil companies generally have been reluctant to pump more, preferring to steer cash flows back to investors instead of spending it on new drilling that could flood the world with cheap crude.”

The oil industry is sitting on 10 years’ worth of unused leases

The oil industry already has at least 10 years’ worth of unused leases at its disposal. They are only producing oil or gas on roughly half of the area they have already leased. There are nearly 14 million acres onshore and more than 9 million acres offshore that are currently under lease but are not being used for oil production. At least one-quarter of these unused leases are sitting on lands that the Bureau of Land Management has deemed to have a medium or high potential for oil. What’s more, only 10 percent of U.S. oil and gas production occurs on federal lands and waters, limiting the federal government’s ability to impact leasing decisions—the other 90 percent is done on state and private resources.

New oil projects won’t bring down prices or increase supply in the short term

Nothing on the industry wish list is a silver bullet to solve the short-term crisis. According to the Government Accountability Office, on average, it takes more than four years for companies to begin producing on the federal lands they lease. Offshore production takes even longer, as it takes at least two to three years to build the needed rigs. This delay is not due to drilling permit review, which—at most—takes fewer than 200 days. Even oil and gas industry executives themselves are saying it: Launching more oil and gas projects now will have no effect on short-term global energy markets.

The United States is now in the era of extreme fossil fuel energy: The opportunities that exist for big new oil projects are not fast, not safe, and are not long-term solutions. Projects such as ConocoPhillips’ Willow in the Western Arctic; calls to drill the Arctic National Wildlife Refuge; or ultradeep offshore drilling are several years if not a decade away from producing oil and only set the country up to continue on the unstable path of a fossil-fuel-dependent future.

23 million

Acres of lands and waters leased to industry but not being used for oil production

4+

The number of years, on average, it takes to begin producing oil and gas after leasing

$75 billion

Record profits posted by Shell, Chevron, BP, and ExxonMobil in 2021

The bottom line is that investments today—whether in fossil energy or renewables—are about our energy systems in a decade. Now is the time to invest in the energy system that will make the United States truly energy independent.

Renewables are winning the free market

For the long-term transition, the market is pointing away from new drilling investments and toward renewables. Take this latest example: In November 2021, the Bureau of Ocean Energy Management held the largest oil and gas lease sale to date and offered 80 million acres in the Gulf of Mexico. The sale has since been rejected by the courts, but the sum of high bids was $192 million—just $25 per acre—and about 97 percent of the bids were uncontested. Compare that to 488,000 acres in the New York Bight region offered for potential wind energy development in February, which drew competitive winning bids from six companies totaling approximately $4.37 billion—about $9,000 per acre.

Conclusion

The United States—and the world—cannot drill its way out of oil price volatility or into real energy independence. Energy prices are high because fossil fuels are a global market highly influenced by conflicts around the world. Increasing leasing and permitting rates even beyond their current historically high levels won’t change that, but it will lock the United States into fossil fuel dependence for decades to come. For true energy independence, for lower energy prices, and for our own health and well-being, we must urgently invest in clean energy.

The authors would like to thank Will Beaudouin for his contributions to this piece.

Last edited by CUDA; 11-27-2022 at 01:54 AM.

We have invented the world; WE see

-

11-27-2022, 01:52 AM #7CUDA

Team Member

This message is hidden because CUDA is on your rat list.

View Post

Remove user from rat list

-

11-27-2022, 01:56 AM #8

-

11-27-2022, 01:59 AM #9

-

11-27-2022, 02:02 AM #10

https://www.api.org/news-policy-and-...and-export-oil

Why the U.S. Must Import and Export Oil

Dean Foreman

Dean Foreman

Posted June 14, 2018

With Wall Street Journal headlines such as “Trans-Atlantic Oil-Price Spread Soars as Supply Glut Disappears,” it might be hard to remember that the United States’ domestic oil production stood at a record 10.5 million barrels per day (mb/d) in April, and the nation’s petroleum trade balance is in its best position in 50 years. This has reinforced U.S. energy security, lowered the trade deficit and boosted economic growth.

That said, given our country’s much improved energy outlook, some may question why we’re still importing crude oil and refined products. And, while we’re still importing oil, why do we export domestic crude – especially when prices have risen at the pump? Why don’t we just keep American oil at home?

In fact, these kinds of questions recently became a partisan flashpoint on Capitol Hill, with a group of Senate Democrats advocating the re-imposition of a ban on crude oil exports. Answers are found in an understanding of basic market realities.

First, while we point out that oil is a global commodity, almost no one consumes oil directly. It must be refined into the fuels, feedstocks, materials and products that we purchase and use in our daily lives. This means that physical characteristics – such as where oil is produced versus where there is refining or manufacturing plants, or the location of the greatest consumer demand – affect its usefulness and therefore value.

At the same time, you need different kinds of oil to make different products and, despite the rapid increase in domestic oil output, significant portions of the oil that is being produced here may not be what is needed to make all of the products Americans use. This underscores the need for flexibility in trading oil internationally – marketing supplies that might not match local needs to global buyers – which is integral to unlocking the United States’ productive potential.

For these reasons and others it’s neither practical nor in our country’s best interest to keep American oil here at home and opt out of the global crude market.

Let’s discuss three factors – oil location, quality and quantity – to understand how U.S. petroleum trade and the policies that foster that trade have complemented the strength in domestic oil production, which in turn has helped to increase global supplies and keep oil prices relatively low and less volatile.

Location

Oil production, refining and demand can differ geographically. A main reason why the U.S. continues to import crude oil and refined products is that much of the infrastructure to produce oil, as well as refine and transport fuels, is in the mid-continent and U.S. Gulf Coast regions.

At the same time, many states with high motor fuel demand lack such infrastructure and instead receive fuels via shipping, rail and trucking. Florida, Oregon and the New England states are prime examples of states that depend heavily on more expensive transportation modes and imports. The map below shows the concentration of U.S. refining and refined product pipelines along the Gulf Coast and in the middle of the country:

Quality

Crude oil is not a homogenous product. The U.S. continues to import and export crude oil because the viscosity of oil (measured by its API gravity) being light or heavy and its sulfur content being low (sweet) or high (sour) largely determine the processes needed to refine it into fuel and other products. In general, refineries match their processing capabilities with types of crude oils from around the world that enable them to:

- Make the most high-value motor fuels and other petroleum products in a cost-effective manner; and,

- Serve niche product markets for chemicals, petrochemical feedstocks, lubricants, waxes and materials for roads and roofs.

While transportation runs primarily on motor fuels, our society also depends on thousands of products that begin as crude oil.

Heavier crude oils contain more complex molecules, so they are better for producing many of these niche products. However, turning heavy oil into high-quality products also requires more advanced molecular processing than is possible with simple refining or distillation.

Consequently, using heavy oil requires substantial capital investments in additional refining processes, such as cracking or coking, or so-called conversion capacity. With the requisite additional investment and processing cost, heavy oil typically has been priced less than light oil. In May, for example, Bloomberg data show that Western Canadian Select (WCS) heavy oil averaged $54 per barrel, while West Texas Intermediate (WTI) light crude oil averaged just above $70 per barrel.

The ability to process the heaviest crude oils has vastly expanded the Western Hemisphere’s oil resource and supply potential, as these oils come mainly from Canada and Venezuela. Therefore, many U.S. refiners are configured generally to process heavy crude oil.

Shifting purely to light crude oil could underserve some product markets and idle (or even strand) the hundreds of billions of dollars invested in refinery conversion capacity. The supply, demand and prices for various crude oils and products have continually solved this equation for producers and refiners to determine the role that crude oils of different qualities should play in the market, in accordance with economic fundamentals.

Since the U.S. energy renaissance has accelerated, however, most of the 4.8 mb/d of new U.S. oil production the past six years has been light oil. With U.S. refining capacity geared toward a diverse crude oil slate, a key implication for U.S. petroleum trade is that it would be uneconomic to run refineries solely on domestic light crude oil. Consequently, the United States:

- Must import crude oil of different qualities to optimize production, given its mix of refining capacity; and,

- Has more light crude oil than it can handle domestically, while this same quality of oil is in high demand in Asia Pacific and other regions that mainly have simple refineries (without conversion capacity).

Therefore, differences among crude oils are important reasons why the U.S. continues to import oil in an era of domestic abundance and export light oil that can be problematic, operationally and financially, to handle with existing U.S. refinery capacity (but also is of great value to refineries globally). This leads our third consideration.

Quantity

The domestic petroleum market has largely been saturated even as the U.S. has played a growing role in expanding global oil supplies. This is indicated by the fact that through the first four months of 2018, U.S. refineries were using 90.6 percent of their capacity – the highest capacity utilization rate for the same four months since 2005. Gross inputs to domestic refineries over the same period set a record of 16.8 mb/d. The point is that U.S. refineries ran about as hard as they could even as U.S. crude oil exports also hit record levels, growing to 1.9 mb/d in April.

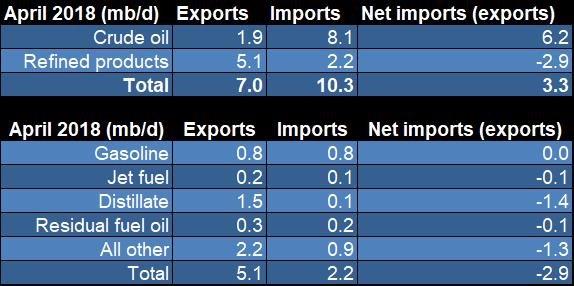

Separately, consider the U.S. petroleum trade balance. In April, the U.S. was a net exporter of 2.9 mb/d of refined products. Consequently, domestic refined product markets have experienced a surplus and have needed export markets to make them viable. Below, the U.S. petroleum trade balance and refined product detail for April, from the API Monthly Statistical Report:

Taken together, it has been a win-win scenario. Refiners have produced as much refined products as possible, more than satisfying domestic needs. At the same time, the expansion we’ve seen in U.S. crude oil exports has largely generated its own new domestic oil production, augmenting the United States’ role as the top global producer.

This matters. Basic economic principles tell us that any restrictions on crude oil exports could force the U.S. market to rebalance to serve only domestic crude oil demand. While there might a period where an oversupply of domestic crude oil could lower prices, the domestic supply of oil has shown an ability to adjust quickly and could effectively stall new investment and downshift U.S. oil production as capital flows slowed, rigs were idled, crews disbanded and midstream infrastructure went into limbo. In any event, restricting crude exports would not break the linkage between domestic and international prices – ostensibly the political objective – since U.S. refined products still would be able to be exported, as they were long before crude oil exports were enabled.

Ultimately, banning exports is misguided energy policy because it could disrupt new sources of crude oil production that otherwise would not be needed domestically, and the supporting economic activity that has accompanied it could be squandered.

To be clear, the different locations, qualities and quantities of U.S. crude oil explain why the U.S. has continued to import and export crude oil even as it has become abundant domestically. These activities are integral to the 10.3 million U.S. jobs supported by the natural gas and oil industry and the broader U.S. economy. The right policies, though, are necessary to help sustain the energy renaissance and continue to foster domestic production.

This means increasing access to resources (onshore and offshore), expanding infrastructure and cogent policies that enhance trade, reduce tariffs and protect investments at home and abroad.

About The Author

Dr. R. Dean Foreman is API’s chief economist and an expert in the economics and markets for oil, natural gas and power with more than two decades of industry experience including ExxonMobil, Talisman Energy, Sasol, and Saudi Aramco in forecasting & market analysis, corporate strategic planning, and finance/risk management. He is known for knowledge of energy markets, applying advanced analytics to assess risk in these markets, and clearly and effectively communicating with management, policy makers and the media.

We have invented the world; WE see

-

11-27-2022, 02:44 AM #11CUDA

Team Member

This message is hidden because CUDA is on your rat list.

View Post

Remove user from rat list

Similar Threads

-

Its the best time in 8 years!

By Robby321 in forum The Scream And Fly LoungeReplies: 0Last Post: 12-06-2016, 09:44 PM -

Went to the Movie's for the first time in Years!

By The Big Al in forum The Scream And Fly LoungeReplies: 0Last Post: 06-17-2007, 12:54 PM -

Ran the 16 Ally/1500XS today for the first time in 2 years

By Raceman in forum General Boating DiscussionReplies: 11Last Post: 06-30-2003, 10:18 AM

Likes:

Likes:

Reply With Quote

Reply With Quote